To check or verify your income tax return submission in Bangladesh, go to the NBR eReturn portal → Submission Verification, enter your TIN and Assessment Year, solve the captcha, and click Verify. If successful, the system will display your return status and allow you to download the PSR (Proof of Submission of Return) for your records.

What Does It Mean to Verify an Income Tax Return in Bangladesh?

Verification ensures that your Income Tax Return (ITR) has been successfully submitted and stored in the National Board of Revenue (NBR) system. Once verified, you receive a Proof of Submission of Return (PSR), which acts as official evidence.

- Entity responsible: National Board of Revenue (NBR), Bangladesh

- Document generated: PSR (Proof of Submission of Return)

- Who needs it: Salaried individuals, businesses, professionals, and anyone required to file returns

Prerequisites Before You Start

To check or verify your return submission online, keep these handy:

- ✅ Taxpayer Identification Number (TIN)

- ✅ Assessment Year (AY) — Example: AY 2025–26 corresponds to income earned in FY 2024–25

- ✅ Internet connection and device (desktop/laptop or mobile)

- ✅ Browser access (Chrome, Firefox, Safari)

Step-by-Step Guide (Desktop Users)

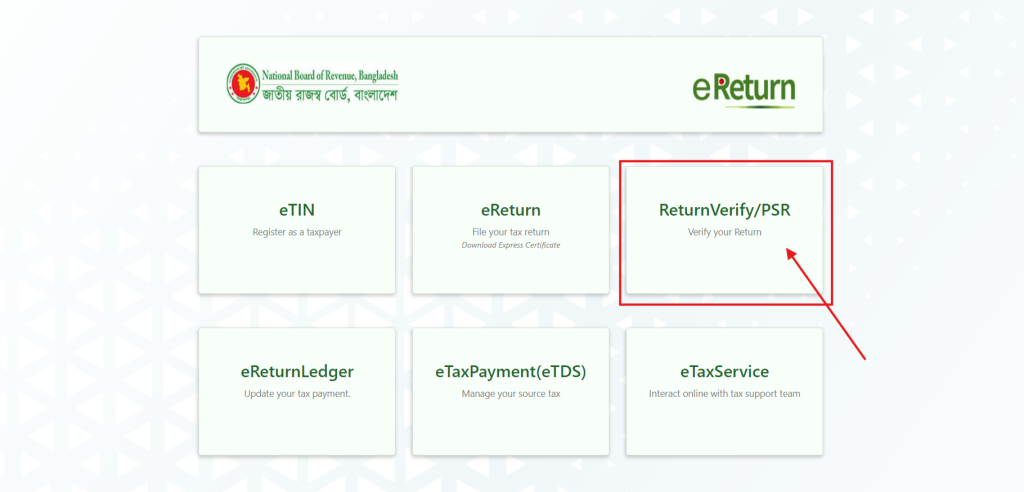

- Go to the NBR eReturn Portal → select Return Verify/PSD.

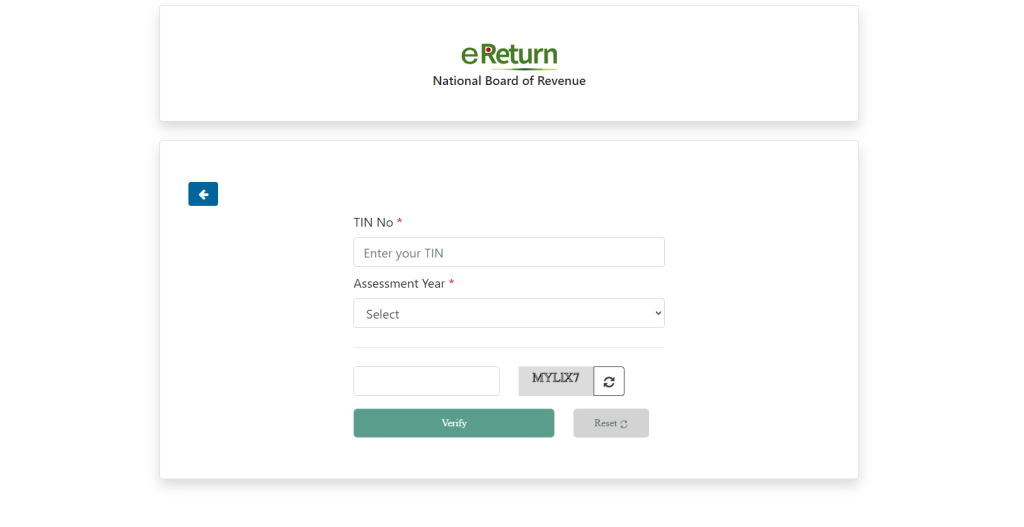

- Enter your TIN and Assessment Year.

- Complete the captcha (refresh if it’s unreadable).

- Click Verify.

- If successful, you’ll see your return status.

- Download and print the PSR (Proof of Submission of Return).

Step-by-Step Guide (Mobile Users)

- Open your browser and visit NBR eReturn → Submission Verification.

- Switch to desktop mode if the page doesn’t display properly.

- Enter TIN and Assessment Year (AY).

- Solve the captcha carefully on smaller screens.

- Click Verify → check status.

- Save the PSR PDF to your phone or email it to yourself.

Understanding Your Result

- Verified: Your return is submitted and recorded. Download the PSR.

- Not Found: Your return has not been filed or the details are wrong.

- Error Message: Usually linked to incorrect TIN, wrong AY, or system downtime.

Troubleshooting Common Issues

- ❌ Wrong AY Selected → Confirm the correct AY (e.g., FY 2024–25 = AY 2025–26).

- ❌ Invalid TIN → Double-check from your previous PSR or tax certificate.

- ❌ Captcha Doesn’t Load → Refresh page or switch browser.

- ❌ System Down → Try during off-peak hours or wait for NBR maintenance to end.

- ❌ No PSR Found → Contact your Deputy Commissioner of Taxes (DCT) office.

Security and Privacy Tips

- Always verify on the official NBR portal (avoid third-party lookalikes).

- Don’t share your TIN or PSR on public computers.

- Save PSR in a secure folder or cloud account.

When Should You Verify Your Return?

- After filing a return online or at a DCT office

- Before applying for loans or visas (banks and embassies require PSR)

- During property transactions, tender applications, or compliance checks

- If you change employers or need to show up-to-date tax clearance

Why PSR Matters

The Proof of Submission of Return (PSR) serves as:

- ✅ Legal confirmation of tax compliance

- ✅ A requirement for bank loans and visas

- ✅ Supporting document for government tenders and licenses

- ✅ Assurance that your return is officially recorded with NBR

Frequently Asked Questions (FAQs)

Q1: What is PSR in Bangladesh income tax?

A: PSR means Proof of Submission of Return, issued by NBR after a return is filed.

Q2: Where do I verify my return submission?

A: On the NBR eReturn portal → Submission Verification.

Q3: What if the captcha doesn’t load?

A: Refresh it or switch browsers; try mobile if the desktop version fails.

Q4: How do I choose the correct Assessment Year?

A: AY is the year after the financial year you earned income (e.g., FY 2024–25 = AY 2025–26).

Q5: Can I download the PSR?

A: Yes, you can download or print the PSR once verification is successful.

Q6: Who should I contact if verification fails?

A: Reach out to your DCT office or NBR helpdesk for support.

Thanks for reading.